change in net operating working capital formula

There would be no change in working capital but operating cash. So the change in NWC is 135000.

Change In Net Working Capital Nwc Formula And Calculator

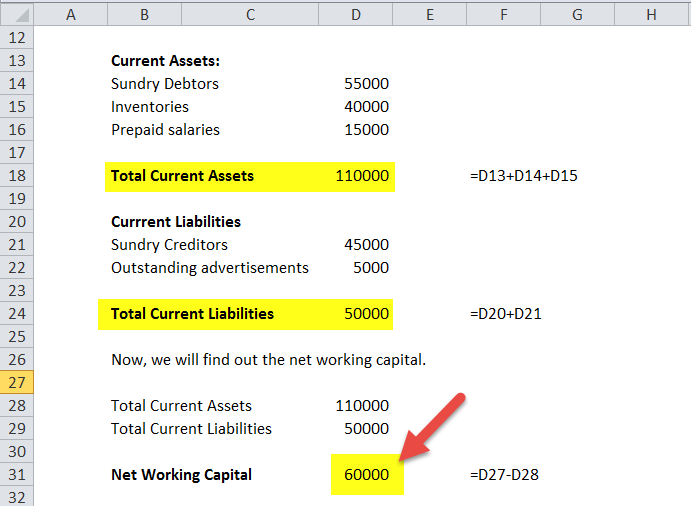

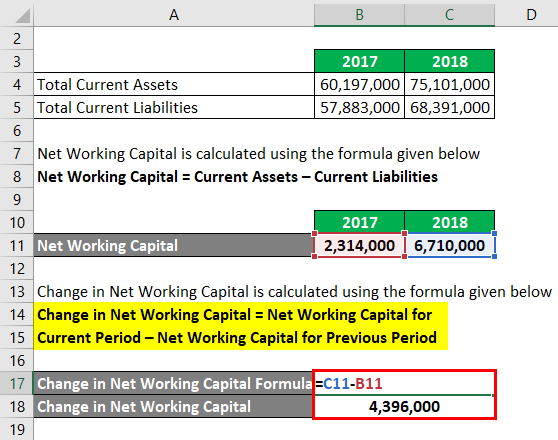

Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Change in a Net Working Capital Change in Current Assets Change in Current Liabilities.

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

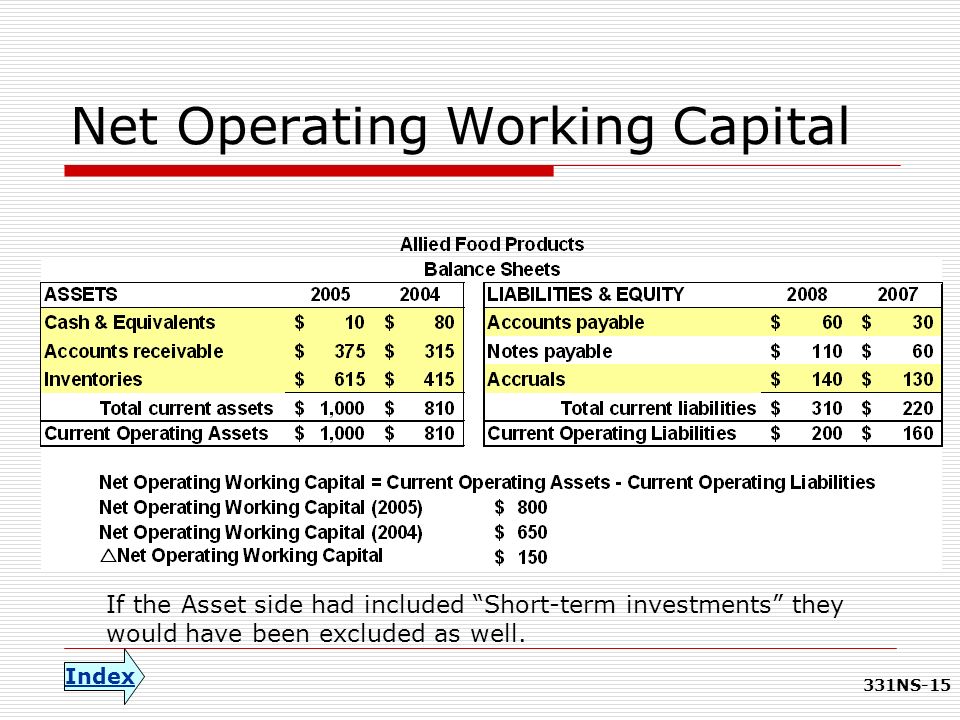

. Business accountants calculate net and net operating working capital the same way where the NWC current assets - accounts payable - expenses. Changes in working capital -2223. This metric is much more tied to cash flows than the net working capital calculation is because NWC includes all current assets and current liabilities.

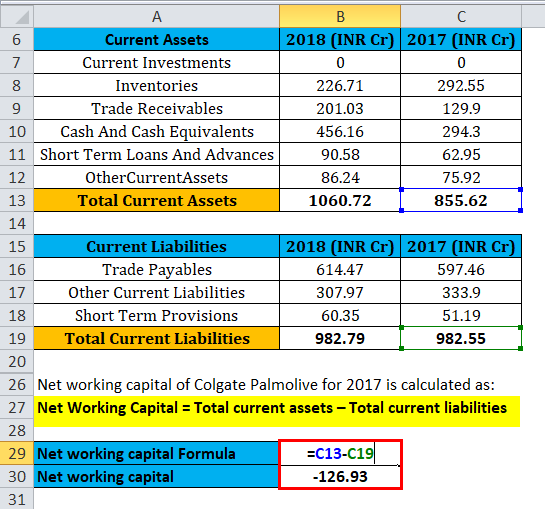

Owner Earnings 8903 14577 5129 13312 2223 13084. Because of this NOWC is often used to calculate free cash flow. Net working capital 7793 Cr.

Working capital also called net working capital is the amount of money a company has available to pay its short-term expenses. Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000. The value of your current assets has changed.

As for the rest of the forecast well be using the. The definition assumes cash is a non-operating asset and. Here are three common formulas for calculating the change.

Total Net Operating Capital Net Operating Working Capital Non-current Operating Assets. Net Operating Assets can be defined as the assets within a business that is related to the operations of the business. You include change in cash as a part of change in overall working capital.

Working Capital Current Period Working Capital Previous Period Changes in Net Working Capital. For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. Working Capital Current Assets Current Liabilities.

Current Operating Assets 50mm AR 25mm Inventory 75mm. Net Operating Assets are basically the representation of how many assets and. Net working capital 106072 98279.

A change in net working capital equals an increase in net working capital. Total net operating capital is an important input in calculation of free cash flow. Net Working Capital NWC 75mm 60mm 15mm.

What is Financial Modeling Financial. The above definition of working capital is a narrow definition representing the day to day operating working capital required by the business. The working capital calculation is given by the following formula.

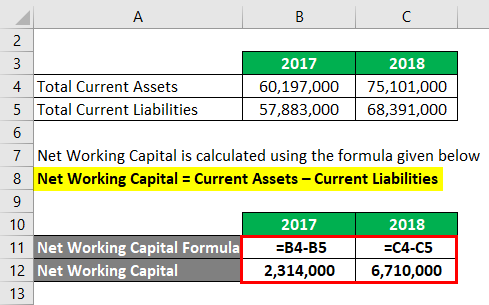

The last step is to determine the change in working capital by using the formula. Net Working Capital Total Current Assets Total Current Liabilities. Net Working Capital Formula Current Assets Current Liabilities.

Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. Change in Current Assets Change in Current Liabilities Change in a Net Working Capital. Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive.

Inventory cash cash equivalents marketable securities accounts receivable and so on are all components of the financial system. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling.

Working capital Inventory Accounts receivable Accounts payable. Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. Cash on hand varies for different companies but having.

Net change in Working Capital 1033 850 183. If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation. 240000 2022 105000 2021 135000.

As per the above table the Net Working Capital of Jack and Co Pvt. It still counts as cash that is tied into running the day to day operations of the business. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

The net operating working capital formula is calculated by subtracting working liabilities from working assets like this. 2 days agoWhat Is Change In Working Capital Formula. Free cash flow equals net operating profit after taxes minus change in total net operating capital over the period.

Net working capital also includes net operating working capital which is the difference between a companys current operating assets and operating liabilities. It is simply defined as the difference between the operating assets of the company and the operating liabilities of the company.

Working Capital Formula Youtube

Why You Need To Know The Working Capital Formulation And Ratio India Dictionary

Net Working Capital Formula Calculator Excel Template

Working Capital What It Is And How To Calculate It Efficy

What Is Net Working Capital How To Calculate Nwc Formula

Net Working Capital Definition Berechnung Beispiel Mit Video

Changes In Net Working Capital All You Need To Know

Net Working Capital Template Download Free Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Financial Management I Review Ppt Download

Is A House An Asset Or Liability Online Accounting

Days Working Capital Formula Calculate Example Investor S Analysis

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)